When your business needs new heavy equipment—a bulldozer, a fleet of trucks, or specialized machinery—you’ll likely need financing to make the purchase possible. However, not all equipment loans are the same. One of your biggest decisions is whether to go with a long-term or short-term loan.

Each option has pros and cons, and the right choice depends on your business goals, cash flow, and how long you plan to use the equipment. In this guide, we’ll break down the key differences between long-term and short-term equipment financing so you can make an informed decision.

Table of Contents

What Is an Equipment Loan?

An equipment loan is a type of business financing that helps companies purchase necessary equipment without paying the full cost upfront. The equipment often serves as collateral, making qualifying loans easier than unsecured loans. Equipment loans can be long-term or short-term, depending on the borrower’s needs.

Short-Term vs. Long-Term Equipment Loans: What’s the Difference?

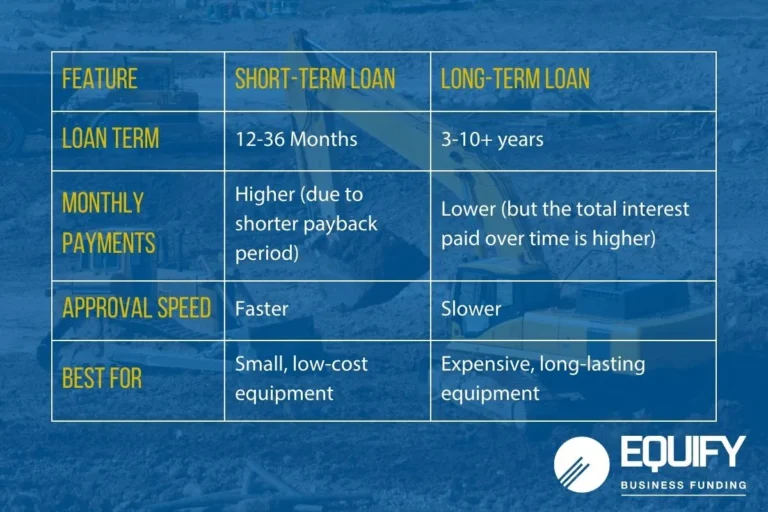

The main difference between long-term and short-term loans is the length of the repayment period and how that impacts your business’s cash flow and financial health.

The Benefits and Drawbacks of Short-Term Loans

Pros:

- Faster Approval: Short-term loans typically require less paperwork and can be approved quickly.

- Less Overall Interest Paid: Since you’re repaying the loan faster, you pay less in total interest than a long-term loan.

- Suitable for Equipment with a Short Lifespan: If the equipment will only be useful for a few years, it doesn’t make sense to be paying for it a decade later.

- Easier to Qualify: Lenders may be more willing to approve a short-term loan, even for businesses with less-than-perfect credit.

Cons:

- Higher Monthly Payments: Because the repayment period is shorter, your monthly payments will be higher, which can strain cash flow.

- May Not Be Enough for Expensive Equipment: A short-term loan might not provide enough capital if you need a multimillion-dollar piece of machinery.

Can Cause Frequent Debt Cycles: Constantly taking out short-term loans can create a debt cycle, where you are always paying off a loan instead of growing your business.

The Benefits and Drawbacks of Long-Term Loans

Pros:

- Lower Monthly Payments: Since the loan is spread out over several years, your monthly payments will be smaller and easier to manage.

- Allows for Bigger Purchases: Long-term loans provide the funding for high-cost equipment that your business will use for many years.

- Better Cash Flow Management: Lower payments mean you have more available cash to cover other business expenses or invest in growth opportunities.

- May Offer Tax Advantages: Some businesses may be able to deduct interest payments and depreciation on long-term equipment loans.

Cons:

- More Interest Paid Over Time: Even though monthly payments are lower, the extended repayment period means you pay more in total interest.

- Commitment to Long-Term Debt: If your business circumstances change, being locked into a long-term loan may limit your financial flexibility.

- Slower Approval Process: Long-term loans often require extensive documentation and take longer.

How to Choose Between a Short-Term and Long-Term Equipment Loan

Not sure which option is best for your business? Ask yourself these questions:

1. How long will you use the equipment?

- A short-term loan may be the best option if the equipment has a short lifespan (e.g., computers, vehicles, smaller machinery).

- A long-term loan makes more sense if the equipment will last a decade or more (e.g., excavators, manufacturing machines, commercial trucks).

2. What is the state of your business’s cash flow?

- Can your business handle larger monthly payments without straining operations? If so, a short-term loan might be a good way to avoid long-term debt.

- A long-term loan is best if you need predictable, lower payments to maintain a steady cash flow.

3. What is the total cost of the loan?

- Typically, short-term loans have higher interest rates, but borrowers pay lower total interest costs because they repay them quickly.

- Long-term loans have lower interest rates, but you’ll pay more in total interest over the life of the loan.

4. How fast do you need the equipment?

- Short-term loans are often approved faster, making them ideal if you need equipment urgently.

- Long-term loans require more paperwork and can take longer to process. Plan ahead if you need financing for a significant purchase.

5. What is your business’s credit score?

- If you have strong credit, you may qualify for favorable terms on a long-term loan.

- If your credit isn’t the best, it may be easier to secure a short-term loan.

Alternative Equipment Financing Options

If neither a short-term nor a long-term loan seems like the right fit, consider these alternatives:

- Equipment Leasing: Instead of buying, you lease the equipment for a set period. Leasing can benefit businesses that need to upgrade equipment frequently.

- Revolving Line of Credit: An equipment revolver is a form of credit where you can borrow and repay funds as needed, offering more flexibility than a traditional loan.

- SBA 7(a) Loans: These loans are backed by the Small Business Administration and usually offer competitive terms.

- Custom Financing: Some lenders go beyond traditional loan options to provide customized financial solutions that fit your business needs.

Find the Best Financing for Your Business

Deciding between a short-term and long-term equipment loan depends on your business’s unique needs, cash flow, and financial goals. No matter which option you choose, compare lenders, read the fine print, and consider how the loan fits into your financial strategy.

Equify Financial knows your industry and will help you find financing solutions that align with your business needs and future goals to set you up for success. The right financing decision can set your business up for success for years. Choose to partner with Equify Financial, and get the financing you need to thrive.