In a new survey, 82% of companies report cash flow disruption due to late customer payment. Whether it’s a slow season, a surprise expense, or waiting on customers to pay their invoices, having cash tied up can make it hard to keep things running smoothly. That’s where a working capital loan comes in. It’s an innovative financial solution that keeps your business moving forward.

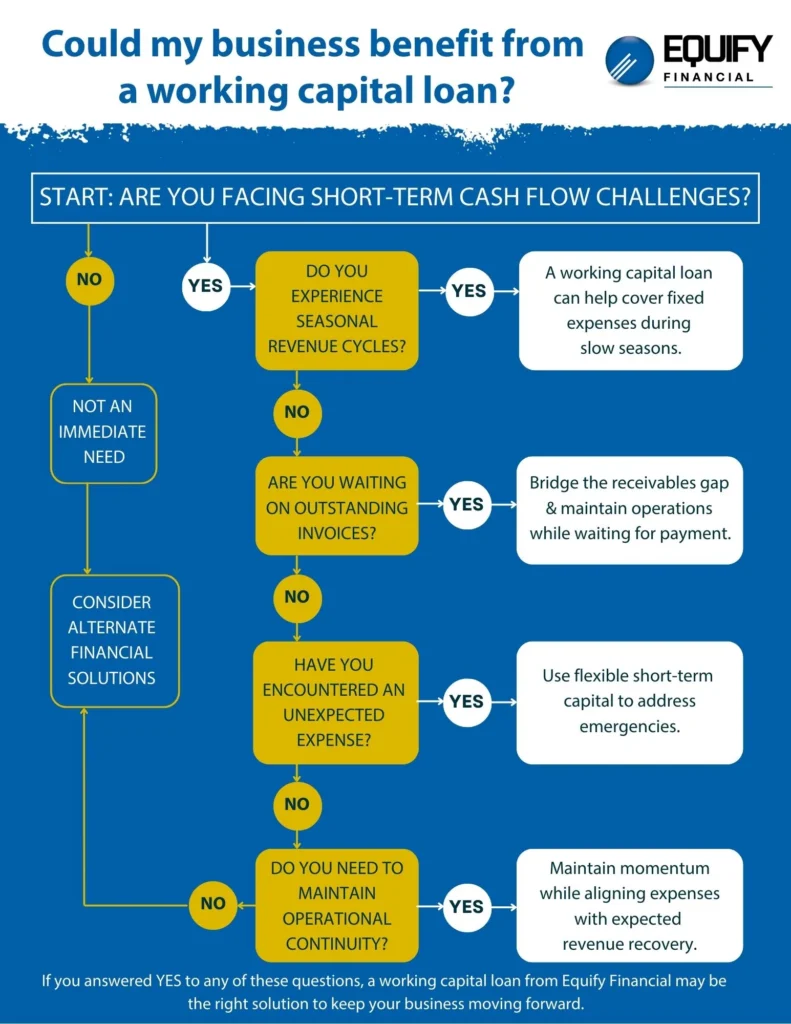

Below are six scenarios and a decision tree to help you determine if this type of financing could be the right fit for your business.

Table of Contents

1. Your Revenue Is Seasonal

If your industry experiences seasonal fluctuations, you know the challenge of keeping things running. Rent, insurance, and payroll don’t stop because it’s your off-season.

A working capital loan can help you:

- Keep your team on payroll

- Cover fixed monthly costs

- Get a head start prepping for your next busy period

Instead of pulling from savings or cutting back, this kind of financial solution gives you breathing room during the slow months, so you’re ready when things pick up again.

2. You’re Waiting on Customers to Pay

If your customers take 30 or more days to pay, that delay can be a strain, especially when you’ve already delivered the work and need to cover your bills.

A working capital loan can help you:

- Fill the gap between invoicing and payment

- Keep your operations moving

- Avoid the stress of juggling invoices

Using financing solutions doesn’t mean you’re in trouble. It’s a solution that creates smooth cash flow to cover short-term needs.

3. Something Breaks, and It’s Not Your Budget

Sometimes things don’t go as planned. A truck needs repairs, equipment fails, or your computers go down. Emergencies like that can’t wait, but paying for them might mean tapping into your emergency fund or delaying other payments.

A working capital loan can help you:

- Address the unexpected issue fast

- Keep your operations on track

- Avoid bigger problems down the road

A flexible capital solution can help you deal with the unexpected without derailing your plans.

4. An Opportunity Pops Up, But You Need to Move Fast

Let’s say a contract opportunity requires you to scale quickly. You could miss out if you don’t have the cash on hand.

A working capital loan can help you:

- Ramp up for a project without delay

- Get fast access to funds for materials and labor

- Boost your operational capacity without using your reserves

In competitive industries, timing is everything. A working capital loan gives you the financial flexibility to take advantage of new opportunities without draining reserves or disrupting your broader strategy.

5. You Need to Keep Things Running During a Slow Patch

Maybe a job got delayed, a payment is late, or the weather affected your work schedule. Even if everything else is going fine, a short-term dip in income can throw things off.

A working capital loan can help you:

- Stay on top of payroll and bills

- Avoid falling behind on obligations

- Keep momentum until income levels out

Using a capital loan to create stability is about keeping things steady, not plugging leaks. It helps maintain stability so you don’t lose ground during a temporary dip.

6. You’re Looking for Strategic Ways to Manage Cash Flow

At the end of the day, a loan is just one tool in your financial toolkit. Short-term financial solutions are good for business if you think strategically about ROI, opportunity costs, and preserving liquidity.

Don’t use a capital loan just to borrow. Intentionally leverage a working capital loan to stay flexible, keep cash flowing, and maximize every opportunity.

Like any tool, this kind of loan isn’t perfect for every situation. You might want to look into other options if you’re funding long-term growth, like opening a new location or buying heavy equipment, or the cost of borrowing outweighs the benefits.

In those cases, longer-term financing or restructuring your current debt might be better.

A Working Capital Loan is About Strategy, Not Stress

Getting a working capital loan doesn’t mean you’re in trouble. It shows strategic planning. Using the financial solutions that fit your business needs shows you care about managing cash flow on your terms, staying flexible, and having the confidence to act when opportunities come your way.

At Equify Financial, we don’t do one-size-fits-all solutions. We help business owners and executives find the financing solutions that fit their operational strategies and support their goals.

Book a 10-minute strategy call with your local Equify Financial rep to explore options for managing cash flow or expanding capacity.